EDITORIAL

Dear Readers,

This year perhaps more than ever before, the real estate industry has demonstrated just how stable it is at coming through a crisis. In particular, the housing industry continues to offer a number of attractive, long-term investment opportunities. Nevertheless, every crisis exposes the shortcomings of and challenges facing any industry. How well does the investment market work against the backdrop of general uncertainty? What will happen to the commercial real estate markets and the major property developments that, just a few months ago, investors were fighting over? And how can digital technologies help to unlock future potentials? These are among the issues addressed by our experts in this edition of the WID newsletter.

We are sure you will enjoy these exciting topics and – most importantly – sincerely hope you stay healthy!

Your JMS und JG

BEITRÄGE

New construction or modernisation – which is more sustainable?

Gabriel Khodzitski | CEO of PREA

New apartments consume less energy than older ones – or do they? After all, with each iteration of the German Energy Saving Ordinance (EnEV), energy-efficiency requirements have become more and more stringent. New insulation techniques and energy-saving heating systems allow for more climate-friendly building operation than ever before. But let’s take a more nuanced look at the question: Are new apartments – viewed holistically – still more environmentally friendly if they require the demolition of an existing building? How does the energy balance of demolition and new construction compare with high-quality, modernised apartments that (almost) meet the standards of new construction?

Only half the story ever gets told

Advocates of modernisation argue that the most important factor in achieving sustainability in the building sector is to preserve existing buildings. Many of the sustainability parameters involved in demolishing buildings and replacing them with entirely new structures are not reflected in debates about the building sector’s energy balance. For far too long, there has been a reluctance to provide a complete balance of a building’s energy consumption over its entire life cycle. There is even a term for it, grey energy, which refers to the “hidden” energy expended on the production, repair and disposal (or reuse) of building materials. According to a study by the Federal Office for Building and Regional Planning, heating, hot water, ventilation and auxiliary power in building operations typically account for up to 40 to 60 percent of the total energy requirements of new buildings. Conversely, 40 to 60 percent of the total energy requirement is expended on construction and transportation. Thus, about half of a building’s negative environmental impact is simply ignored when calculations are limited to the annual primary energy balance according to EnEV rather than taking a far more holistic view.

A lack of transparency creates unnecessary hurdles

However, grey energy is difficult to quantify. There are data, for example, on how much CO2 is emitted during the production of one ton of steel – in 2018, 1.7 tons of CO2 were emitted during the production of each ton of crude steel – but these data only apply to one specific production method. Even with such data, there is no getting around the fact that CO2 emissions depend largely on whether materials are manufactured using green energy or not. Perhaps the move towards ESG reporting will shed more light. After all, a growing number of construction and real estate companies are starting to publish non-financial data on their activities, including their carbon footprints. The more granular these data, the greater the transparency of the market – even down to the climate impact of individual construction components used by each company. And the better the data, the easier it is to decide on a case-by-case basis which approach is truly more sustainable.

The future importance of mobility

However, producing a complete energy balance could well mean going further than “just” including grey energy. For example, what vehicle emissions are associated with the property? Do long journeys cause ecological damage because a property is not surrounded by supermarkets, workplaces and daycare centres? Do residents use their own vehicles because the property is poorly connected to public transport? Is the property equipped with charging stations for electric vehicles? And if not, is the energy infrastructure robust enough to allow a large enough number of households to opt for an electric vehicle? And how practicable are the chosen solutions? According to the energy provider Eon, a conventional charging station can be installed at a cost of around EUR 5,000, while rapid charging stations can cost up to EUR 120,000 each. All in all, this is certainly one area in which newly constructed apartment buildings (or better yet, the new construction of an entire neighbourhood) should come out on top. After all, it is probably easier to develop this kind of infrastructure from scratch than it is to replace existing systems. However, even here, there is no one-size-fits-all answer.

The need to optimise both approaches

One thing is already clear: Whether they are constructing new buildings or modernising existing ones, developers and other real estate companies will need to come up with solutions to improve the energy balance and sustainability of all of their projects. And to do so, they will need to start seriously analysing the topic of sustainability in all its facets right now.

Are rental condominiums the ideal solution to residential developers’ woes?

Jens R. Rautenberg | Managing Director of CONVERSIO

The impact of the coronavirus pandemic on apartment sales in Germany has varied. In many markets, sales to owner-occupiers have taken a real tumble. Given the general climate of uncertainty right now, a large proportion of German households, and especially those on middle-incomes, are happy to continue living as renters rather than making the long-term commitments associated with buying their own homes. For decades, developers have always assumed that they would have no problems quickly finding owner-occupiers for their most attractive penthouses and well-situated garden apartments. Even those days now seem to have passed.

Investments in rental condominiums are on the rise

Demand for investment condominiums, in contrast, would seem to have surged. There are still an incredibly large number of high-equity private investors who are keen to invest in rental condominiums, largely because they simply cannot find attractive, high-yield alternatives anywhere else on the market. They are also attracted by the fact that rental housing is regarded as a particularly inflation-proof investment and fears of inflation are starting to re-emerge right now.

Exploiting new sales and marketing channels

This divergence in the market is also being noticed by developers, who have started cutting back on sales and marketing campaigns that target owner-occupiers. In response to the shift in the market, residential developers are marketing a far larger proportion of their new dwellings to private investors. However, many developers have failed to understand that this requires an entirely different marketing strategy.

The need for professional prospectuses

Marketing materials are one such example: These are no longer merely sent out to real estate agents, but also to financial service providers and investment advisors. Nevertheless, many developers haven’t changed their prospectuses. Rather than designing them according to the IDWS-4 standard and thereby reducing property developer liability and meeting the requirements of financial service providers, they have adopted a business as usual approach.

Sales and after-sales management

And are developers set up to deliver best-in-class sales and after-sales support? In other words, do they have the personnel and the know-how to deal with financial and investment advisors for years of sales and after sales? Developers certainly need to be aware that investors and investment advisors can be quite demanding clients.

Risk diversification

Compared to units for owner-occupiers, condominiums for investors also need to satisfy different requirements. While owner-occupiers tend to prefer larger apartments with high-quality furnishings, investors are more interested in smaller and simpler apartments with less intricate floor plans. In order to spread the risk of their real estate investments, forward-looking investors would often rather buy two smaller units in different locations than one large dwelling, however attractive it might be.

The sweet spot is somewhere between 40 and 90 square metres

Developers who are still in a position to redesign their projects should therefore review their plans and gear their pipeline projects to small, highly rentable units. The most marketable floor plans will depend on the individual market, but are likely to be between 40 and 90 square metres.

Setting prices

When it comes to calculating the prices of individual units, developers should also bear in mind that financial service providers and investment advisors, unlike traditional real estate agents, are often not used to charging a broker’s commission to their clients. The agent’s commission, then, is usually paid in the form of an internal commission. And this tends to be slightly higher than the classic internal commission for brokers.

Energy and ESG – success depends on the strength of your vision

Norman Schaaf | COO of Cells Group

The energy transition forces property developers to find new ways of doing things. The use of more environmentally-friendly construction materials is just one factor on the road to improving the sustainability of real estate. We also need to improve the way we manage buildings over their entire life cycles and, perhaps most importantly, have the courage to find creative solutions.

The basic idea is as simple as it is ingenious: a building that goes beyond net-zero energy consumption and actually generates a surplus of energy. While nobody is expecting a perpetual motion machine to be developed anytime this century, existing technologies certainly offer the potential to create energy-autonomous buildings in the very near future. For engineers and building owners alike, this raises fundamental questions about the costs and benefits of such solutions – which approach is really worth pursuing, what difficulties can be expected, what work still needs to be done before we can make the next developmental leap?

Nothing can be achieved without sensor technologies and connectivity

One essential fact needs to be clarified up front: Active energy management is set to play a key role in the future, not only in terms of comfort but also in terms of sustainability. This may sound paradoxical at first, because many architects and engineers around the world are working at full speed to find ways of using passive methods to optimise the energy and heat balance of their buildings – and additional electronic systems and computing power naturally consume additional electricity, at least at first.

Nevertheless, this is by no means a new approach. Plenty of buildings have used rivers to supply water for domestic use. Others have incorporated greenhouses into and around dwellings, or used insulating layers of earth to create so-called earthships. Ever since the 1970s and even earlier, innovative pioneers have been testing a wide variety of solutions, some of which have even made it into the mainstream. Still, as important as these contributions have been – and as effective as external blinds, for example, are in comparison to energy-intensive air conditioning – the vast majority of these innovations have delivered little more than incremental benefits. They need to be intelligently combined and controlled in order to take the next significant developmental leap.

Photovoltaics – from bright spark to damp squib?

Photovoltaic solar cell technologies have also been tried and tested for years, but are rarely seen as a panacea. In the early years of the new century, many were pinning their hopes of an emissions-free future on the solar revolution. Disappointment soon followed as people realised that the efficiency of photovoltaic systems is limited by numerous factors, including their location. In Europe, this means that the further south your solar cells are located, the greater the likelihood of them being exposed to intensive solar radiation. Anywhere else and they cannot hope to have a major impact on energy generation.

In addition to questions over the service life of such systems, their potential is also limited by operational issues: the angle of the roof, potential sources of pollution in the immediate vicinity, insufficient wind to efficiently cool the photovoltaic modules – the list of potential limitations is long. And each results in less energy being produced. As a result, the future for solar energy doesn’t look so bright – despite subsidies and tumbling prices, even ambitious Germany has failed to expand its photovoltaic network in line with expectations. Despite the German government’s target of 98 gigawatts of photovoltaics by 2030, the installation of new systems has been running well behind schedule for years now.

Hybrid concept: high-rise and wind turbine in one

If you want some better news regarding energy self-sufficiency, you need to look abroad and away from photovoltaics. In small Bahrain on the Arabian Peninsula, for instance, plans for the world’s first net-zero emission skyscraper were announced in 2007. The Burj al-Taqa was designed to be energy self-sufficient and even generate surplus energy at peak times. And, although the project fell victim to the global financial crisis of 2008 and there were still some potential technical issues that needed to be resolved, there is no disputing the impressive vision behind the project.

The fact that such ambitious projects could actually be implemented in the near future is demonstrated by another pioneering skyscraper, the Bahrain World Trade Center, which opened in 2008. At 240 metres, it is taller than Germany’s second tallest building and sets an impressive precedent as the world’s first high-rise to feature integrated wind turbines. In fact, there are three separate turbines fitted to the cross struts that connect the building’s twin towers. I am certain that these turbines, the highest of which is about 125 metres above the ground, are just a foretaste of future technologies – and proof of what is possible when people follow their visions.

Nationwide rent cap?

Jürgen Michael Schick | President of German Real Estate Association IVD

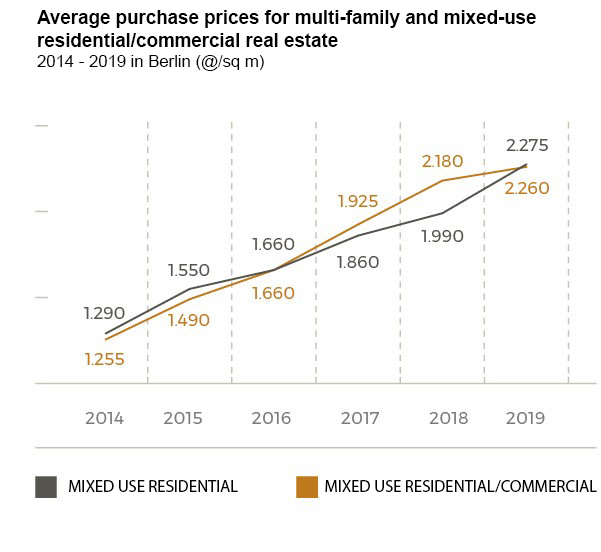

For the first half of 2020, Berlin’s official Property Valuation Committee has reported a sharp drop of one third in residential and commercial property transactions. Average purchase prices were also significantly lower than in the first half of 2019, having declined by as much as 11 percent. The news of the dramatic slowdown in the residential investment market has blindsided many market observers. It certainly looks as if the coronavirus pandemic and rent cap have combined to put a major damper on the overheated rental housing market in the German capital in the first six months of this year.

The decline in the number of transactions is primarily due to the general wait-and-see approach adopted by many market participants in the first half of the year. This was most evident in the second quarter, when many market players kept their powder dry. Many hunkered down to wait and see how the pandemic would play out and what impact it would have on the economy. In contrast, the Property Valuation Committee emphasised, the 11-percent reduction in prices was little more than a statistical blip – the result of a comparatively large number of transactions involving high-priced new buildings in 2019. My impression, too, is that purchase prices for classic apartment buildings in Berlin have remained surprisingly stable and have not been affected by the pandemic in the slightest. And, as the second half of the year got underway, the market picked up considerable momentum. It doesn’t take a lot of imagination to picture the residential investment market emerging from the crisis almost entirely unscathed.

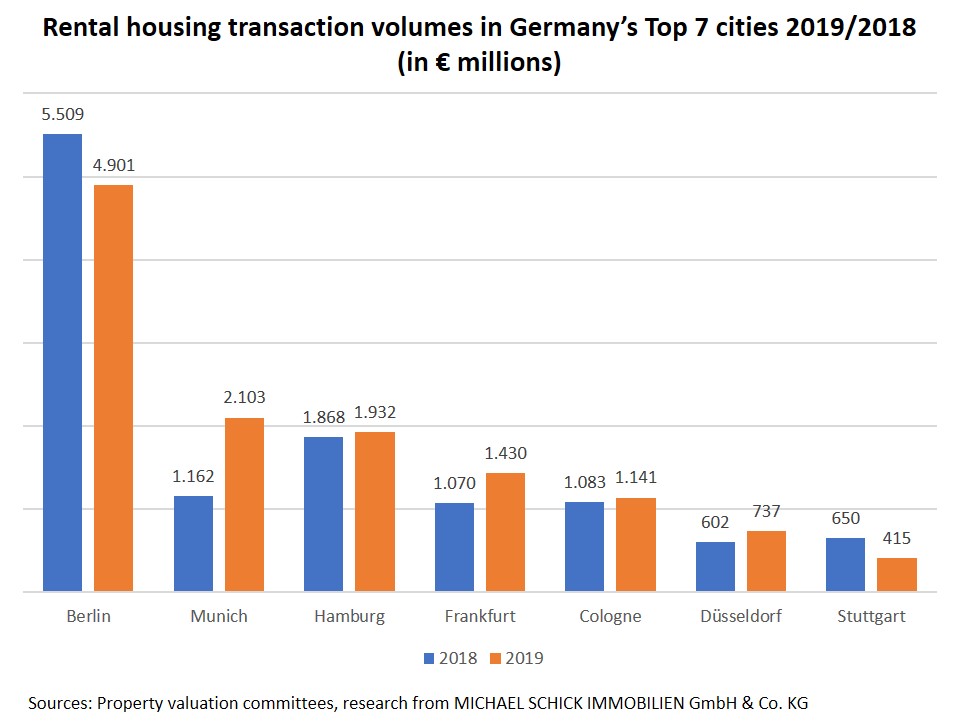

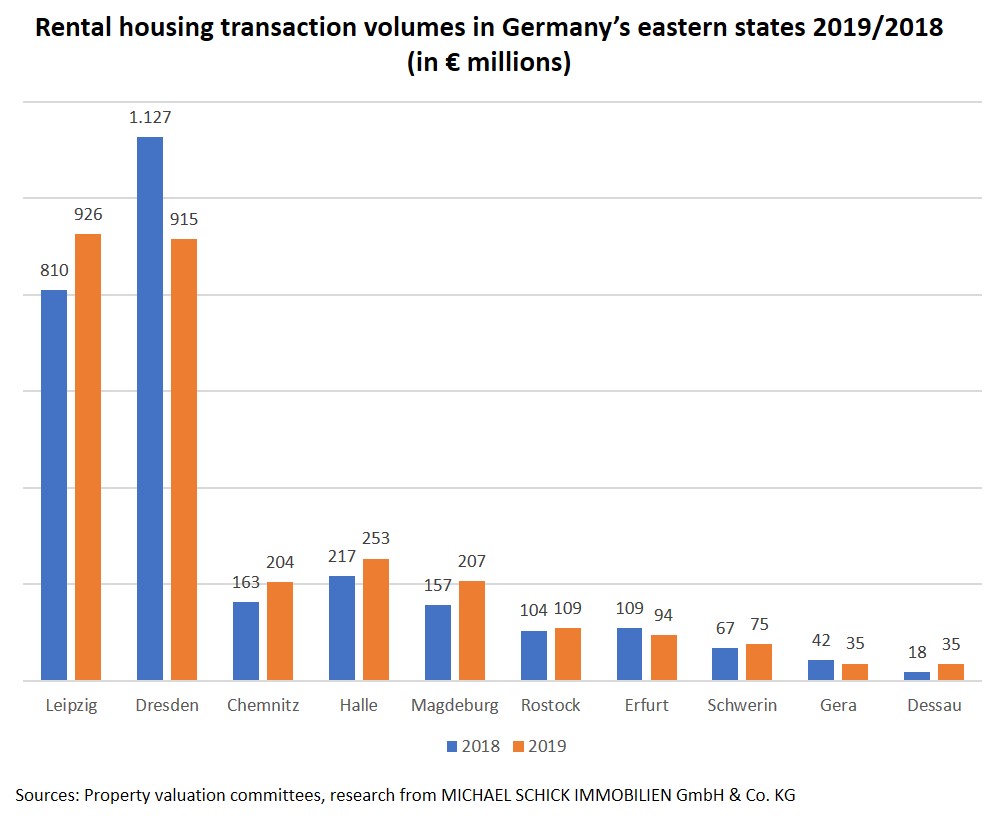

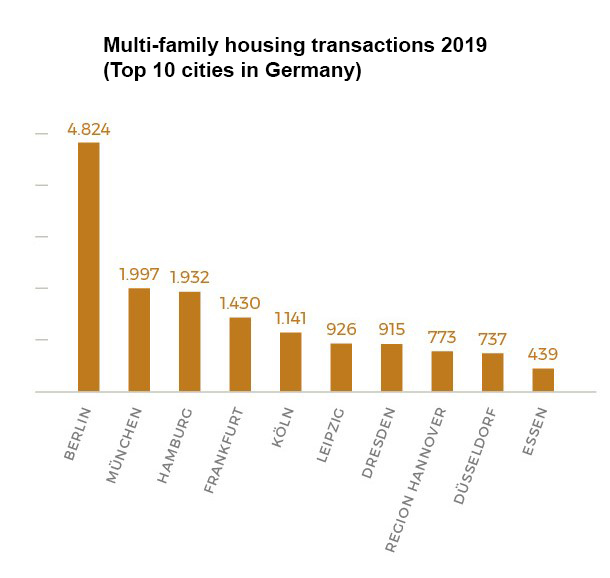

There is no way Berlin is going to relinquish its crown as the leading residential investment market in Germany. To gain a true understanding of the extent of Berlin’s dominance, it is worth looking at aggregated data from the official Property Valuation Committees across the whole of Germany, which are currently available, but only for the previous year. In keeping with the long-term pattern, Berlin registered a transaction volume two and a half times larger than Munich or Hamburg in 2019. A total of EUR 4.824 billion were transacted on multi-family real estate in Berlin, compared to EUR 1.997 billion in Munich and EUR 1.932 billion in Hamburg. In the smallest city in Germany’s top 10, Essen, transactions totalled just EUR 439 million.

Mixed-use residential/commercial buildings are a distinctly metropolitan product. As the latest German Residential Investment Report from MICHAEL SCHICK IMMOBILIEN GmbH & Co. KG reveals, a combined EUR 22.26 billion flowed into this market segment in Germany’s 45 largest cities last year. The top 7 cities alone accounted for 56 percent of the total, namely EUR 12.48 billion. Munich, Hamburg, Frankfurt, Cologne, Leipzig, Hanover and Düsseldorf all reported year-on-year transaction volume growth. Berlin, Dresden and Essen, on the other hand, all registered annual declines. Incidentally, the report’s most expensive market remains – as in every ranking of Germany’s residential markets – the Bavarian capital, Munich, which recorded the highest prices per square metre, at an average of EUR 6,900. In contrast, the average square-metre price for an apartment in Berlin is just a third of the Munich average.

Mixed-use residential/commercial buildings are a distinctly metropolitan product. As the latest German Residential Investment Report from MICHAEL SCHICK IMMOBILIEN GmbH & Co. KG reveals, a combined EUR 22.26 billion flowed into this market segment in Germany’s 45 largest cities last year. The top 7 cities alone accounted for 56 percent of the total, namely EUR 12.48 billion. Munich, Hamburg, Frankfurt, Cologne, Leipzig, Hanover and Düsseldorf all reported year-on-year transaction volume growth. Berlin, Dresden and Essen, on the other hand, all registered annual declines. Incidentally, the report’s most expensive market remains – as in every ranking of Germany’s residential markets – the Bavarian capital, Munich, which recorded the highest prices per square metre, at an average of EUR 6,900. In contrast, the average square-metre price for an apartment in Berlin is just a third of the Munich average.

BERLIN RESIDENTIAL INVESTMENT MARKET

News

Cabinet approves condominium conversion ban

In regions with overheated housing markets, it looks likely that owners of rental apartments will soon require permission from local authorities to convert them into condominiums. This is the result of a federal cabinet decision to approve a national condominium conversion ban. It is now up to the federal states to decide which regions have overheated housing markets. The centre-left SPD was the most vocal advocate of a conversion ban and pushed for it to be included in the new Building Land Mobilization Act. Federal Minister of Building Horst Seehofer (CSU) had originally included the conversion ban in an early draft of the Act, before deleting it from a subsequent version. The SPD then threatened to block the law unless he reinstated the ban – and seems to have succeeded with its threat. The new ban needs to be approved by the upper house, the Bundestag, and would initially apply until the end of 2025. If the ban is approved, it will then be inserted as a new Section 250 of the Federal Building Code (BauGB). The ban does make provisions for a number of exceptions, including the sale of apartments to relatives and heirs. The parliamentary factions of the CDU/CSU have criticised numerous aspects of the ban, such as the fact that it impinges upon the property rights of landlords.

Not a market for foreign investors?

The Federal Ministry of the Interior has joined forces with the Federal Institute for Research on Building, Urban Affairs and Spatial Development (BBSR) to launch a research project to assess the impact of foreign investment in Germany’s residential investment market. The project was first mentioned in the minutes of a meeting with representatives of other federal and state ministries in Berlin and Bavaria, which have been seen by Immobilien Zeitung, and aims to find out whether foreign investors work with shorter investment horizons, have higher yield expectations and invest less in regular maintenance than domestic buyers. The minutes of the meeting did not specify where the data for the project would come from. To date, notaries, property valuation committees, land registry offices and municipal real estate offices do not document the nationality of property buyers. It remains to be seen whether potentially discriminating against buyers on the basis of their nationality would be at workable or enforceable, especially given legislation on the free movement of capital and rights of establishment within the EU.

The Berlin market is carrying on regardless

Even in this exceptional year, prices for residential real estate have risen in almost all Berlin submarkets. The latest figures are published as part of the IVD Berlin-Brandenburg’s real estate price service and are based exclusively on the actual prices paid for residential and commercial real estate in the Berlin-Brandenburg metro region. “Seven months after the start of the coronavirus crisis, the Berlin real estate market has so far remained largely unaffected”, commented Katja Giller, Chair of the IVD Berlin-Brandenburg’s Valuation Committee.

Since the introduction of the city-wide rent cap, the supply of rental apartments plummeted. Rents for new-build apartments are not covered by the rent cap and have risen by 4.3 percent to an average of €12.25/sq m in average locations and by 3.7 percent to €14.00/sq m in more upscale locations. Because of the rent cap, which effectively sweeps away all normal market principles, the IVD decided not to collect data for older apartments. In terms of condominium prices, units in upscale neighbourhoods in Berlin-Mitte remain the most expensive. Prices for existing properties in average locations continue to rise steadily and gained 6.8 percent, although the increase this year has been weaker than in previous years (2019: 11.3 percent, 2018: 12.8 percent, 2017: 12.0 percent). Nevertheless, some things never change: The highest residential real estate prices are still being registered in sought-after Berlin-Mitte (€5,100/sq m) and Charlottenburg (€4,700/sq m).

Apartment buildings and forward deals of the month

Fully-let, classic Berlin apartment building and 1980s mixed-use building from private owner in sought-after Neukölln neighbourhood

This offer from a private owner consists of a purely residential, classic Berlin apartment building from 1919 and a mixed-use, residential/commercial building from 1985, which was added to the existing structure as a street-front and corner building. The older, five-story building contains 14 residential units, most of which are equipped with balconies and are accessible via a central staircase. The 1980s building has six full floors and a converted attic and accommodates 19 units, accessible via a staircase and an elevator. The property is ideally located for easy access to public transportation.

Price: €7,700,000 plus 6.96% commission (incl. VAT)

Lettable area: 2,410 sq m

Annual net rent: €225,286

Information acc. to energy performance certificate: energy consumption 133.3 kWh/(m²*a), energy-efficiency class E, oil-fired heating, built in 1985/1910

(Please quote property reference number 52263 when making your enquiry)

Exquisite, Wilhelminian-style apartment building plus new-build in central Oranienburg

This mixed-use, residential/commercial property comprises a renovated and well-maintained apartment building from 1905 and a newer building from the 1990s situated on a 1,260 sq m plot. The buildings’ units are accessed via three staircases. The apartments’ floor plans range from 36 sq m to 82 sq m and the average net rent is €6.76/sq m/month.

Price: €3,990,000 plus 6.96% commission (incl. VAT)

Lettable area: 1,493 sq m

Annual net rent: €123,280

Information acc. to energy performance certificate: energy consumption 82 kWh/(m²*a), energy-efficiency class C, natural gas, built in 1905

(Please quote property reference number 52251 when making your enquiry)

Commercial property at prime location in Erfurt

This well-maintained commercial property features impressive modern architecture and a light-flooded atrium. The building is in excellent condition and there is no noticeable maintenance backlog. The property has15 units, all of which are let, and 139 underground parking spaces. Constructed in 1995, access is provided by three staircases and three elevators. The commercial building is located within easy walking distance of Erfurt’s main train station.

Price: €14,100,000 plus 5.8% commission (incl. VAT)

Lettable area: 6,811 sq m

Net annual rent: 836.136 EUR

Information acc. to energy performance certificate: energy consumption 93 kWh/(m²*a), energy-efficiency class C, natural gas, built in 1995

(Please quote property reference number 51595 when making your enquiry)

Mixed-use residential/commercial building in popular Berlin-Friedrichshain

The property, which was renovated in 1995, comprises a street-front building, side wing and rear wing. The 21 apartments and two commercial units are accessed via three separate stairwells. The average apartment rent is €8.32/sq m/month. The two commercial units are rented for an average of €11.69/sq m/month. The 250-sq m attic offers great conversion and/or expansion potential. The building has a gas heating system.

Price: €4,950,000 plus 6.96% commission (incl. VAT)

Lettable area: 1,425 sq m

Net rent: €149,003

Information acc. to energy performance certificate: energy consumption 137.9 kWh/(m²*a), energy-efficiency class E, natural gas heating, built in 1905

(Please quote property reference number 52284 when making your enquiry)