Residential Investments in Germany – including Berlin Residential Investment Market – June 2020

22. Jun 2020

22. Jun 2020

Dear Readers,

The coronavirus crisis has shown us that the housing market is healthy and stable. While many sectors of the economy, including other real estate segments, have weakened, demand for residential space remains constant. Nevertheless, this is no time for investors and buyers to sit back and relax. Numerous tenants are facing potential financial difficulties – which is where a smart service charge policy can come into play, as Frank Wojtalewicz from d.i.i. explains. At the same time, many investors are asking whether the current price corrections will create attractive opportunities for quick movers and, above all, in which markets the best growth potential awaits. Join André Schmöller of Domicil and Professor Steffen Metzner of Empira as they answer these questions and more.

We are sure you will find much food for thought in this, the latest edition of our newsletter.

Jürgen Michael Schick and Dr. Josef Girshovich

Professor Steffen Metzner MRICS | Empira Gruppe

Rental housing represents a stable and sustainable investment with relatively predictable rental income. Over the last few years, rents have risen in almost all segments. In view of the current cycle, however, risk awareness is growing. It is therefore becoming more important to focus on locations that offer the highest levels of stability. A new study from Empira analyses a range of primary, secondary and tertiary housing markets using socio-economic and market-related criteria. As the study shows, population growth is a decisive factor in the development of rents.

Residential rents are not a product of chance and housing markets do not develop autonomously. Rental prices and the provision of housing are clearly dependent on supply and demand. Both factors in turn depend on upstream variables. The most important of these are the socio-economic parameters of population and income growth and the overall economic landscape. Against this backdrop, it is interesting to observe whether these influencing factors develop constantly or vary over time and in clusters, whether they track developments in rental prices and whether any such correlations are clearly or only weakly discernible.

Population growth is the main driver of the housing markets. Even with low incomes, population growth ensures that the total budget available for rental payments in any given location increases. Every rise in population ultimately leads to an increase in demand for housing – both in terms of floor space and the number of individual units as well as in terms of the tenants’ willingness and ability to pay. In the case of national data for Germany as a whole, population growth is mainly attributable to net migration. Dynamic growth in immigration figures is clearly reflected – albeit usually with a time lag – in adjustments to new contract and in-place rents. What is more, current volumes of housing construction are too low to fully compensate for the additional demand, thereby fuelling price rises.

Population growth is not limited to Germany’s major cities

It is also well worth comparing population growth and rental price inflation in individual cities and clusters between 2013 and 2018. The study analyses 60 German cities in detail and reveals that population growth is not only limited to Germany’s Top 7 cities. While Frankfurt registers strong population growth (+7.4% in five years), a few secondary and tertiary cities, including Leipzig (+10.6%) and Potsdam (+10.3%) reported even stronger growth. As you would probably expect, mean population growth is highest in primary investment locations at 5.3%. However, at 4.8%, mean population growth in the tertiary investment cluster is a mere 0.5 percentage points behind the Top 7 cities. In addition, this figure also beats mean population growth in the larger secondary investment markets by a full 1.5 percentage points.

A parallel consideration of rents reveals that rental price inflation is considerably higher than the rate at which the population is growing. And, as the study shows, there are certainly differences between the respective size clusters. This applies both to different time periods and to individual cities. The primary investment locations (Top 7) are ahead in terms of both rental prices and rental inflation. With rental price growth of 25.1% over five years, rents in the Top 7 are clearly rising faster than anywhere else. In direct comparison, the study’s lowest growth rates are recorded in smaller, tertiary cities at the bottom of the ranking, even though their population growth figures almost match the rates seen in the Top 7. In terms of rental growth, however, their figure of 17.9% is slightly behind the secondary locations, where rents rose by 19.4%. This could be due to base effects or larger housing reserves. These additional effects will need to be investigated further.

The study concludes that Germany’s Top 7 cities have registered both the largest population growth and the highest rent increases in recent years. The cluster of smaller cities is only 0.5 percentage points behind in population growth, although it lags far behind in terms of rental price growth. This observation points to significant catch-up potential that could be exploited in years to come.

Frank Wojtalewicz | Managing Director of d.i.i. Deutsche Invest Immobilien

The development of residential rents is causing a growing number of residential property investors serious headaches – and not just as a result of the coronavirus crisis. Although the effects of the pandemic on the economy and the labour market are likely to lead to completely new and unique challenges for residential property investors, it should not be forgotten that the flattening of the rental growth curve was an increasingly pressing issue long before the Covid-19 pandemic.

On the one hand, the slowdown in rental price growth is a direct result of changes to government housing policy in recent years, which have led to a growing number of regulatory interventions in tenancy law at ever shorter intervals. On the other hand, the loss of momentum in rental price growth can also be explained by the fact that households in many large cities have reached the limits of what they can afford to pay for their housing. For many households, housing costs (also known as the housing burden) now account for between 30% to 40% of their household income, which means that higher rental prices are simply no longer affordable.

In many cases, this now makes it difficult for residential real estate investors to achieve both their desired rental yields and target exit yields. And the situation has been exacerbated by the intense pressure to invest and enormous capital inflows into the real estate sector in recent years, both of which have driven property prices to levels that could only be seen as sustainable when viewed through a prism of hope for future rental price increases. Nevertheless, with the right strategy it is still possible for investors to increase the return on their investments (ROI) and simultaneously minimise increases to tenants’ housing burdens. Moreover, the right strategy also hedges against future housing policy risks.

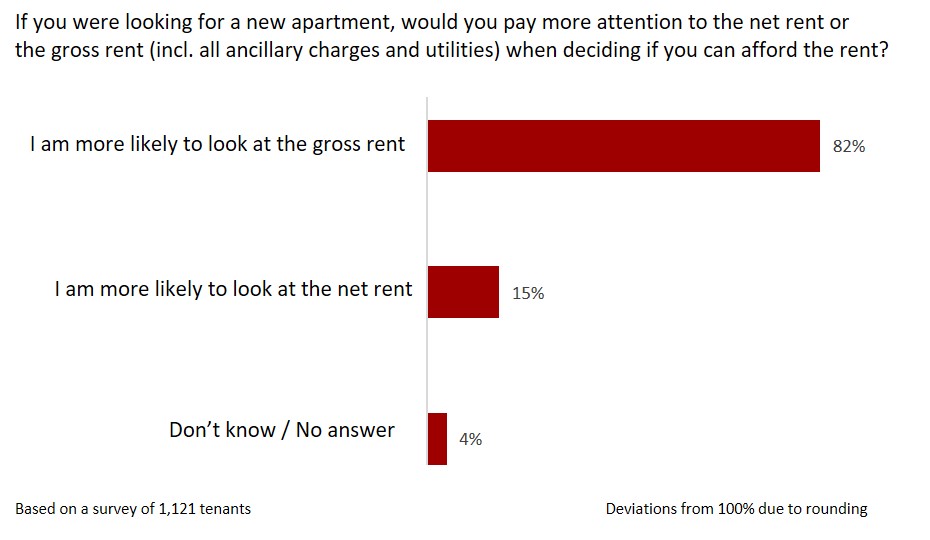

Tenants know: It is the gross rent that counts

When a tenant considers their housing burden, they are not primarily concerned about the net cost of their home, they look at the bottom line: the gross rent, including all ancillary costs. For investors, ancillary housing costs thus represent an efficient – and yet all too often neglected – lever to boost their ROI without significantly increasing the burden on tenants. A representative YouGov survey conducted at the end of 2019 reveals that tenants are aware of this fact: 82% of surveyed tenants are more likely to look at the gross rent than the net rent when assessing their own housing burden. Tenants are therefore concious of the influence of ancillary costs – especially since, according to the survey, almost half of the tenants rate their ancillary living costs as too high.

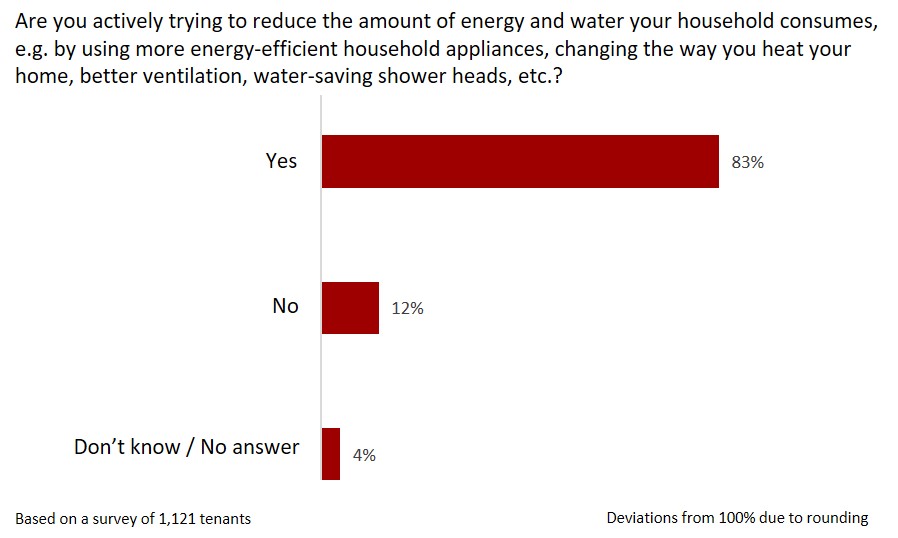

This creates effective opportunities for investors to not only implement their own yield optimisation strategies, but to do so in a socially responsible way. There are two key levers in particular: energy-efficient refurbishment and the optimisation of supply and service contracts.

Large housing companies have an advantage

In many cases, the potential for energy-efficiency refurbishments is considerable, especially in relation to older properties. There are a wide range of measures that can be implemented to reduce energy consumption – renewing the roof, installing a heat recycling system, installing a new heating system, replacing windows, etc. Where modernisation programmes primarily consist of such measures, a balcony could also be added to increase the value to tenants and add extra rental space without adding significantly to the tenant’s housing cost burden.

This is especially true where ancillary costs are optimised alongside any energy-efficiency gains. Proactively managing ancillary costs requires expertise and some effort. After all, benchmarking operating costs, regularly reviewing supply contracts for gas, oil, district heating and electricity, as well as services and contracts for building supervisors, maintenance and cleaning services, can be extremely tedious. Especially as you are only likely to be successful in renegotiating all of these contracts if, firstly, you have negotiating experience and competence in the field and, secondly, you have a sufficiently large pool of customers behind you to strengthen your negotiating position. And this is precisely why larger portfolio holders have a clear advantage.

Minimising political and financial risk

But ultimately, such efforts bear fruit: By consistently deploying and combining two primary levers – energy-efficiency refurbishments and renegotiating supply and service contracts – our company regularly manages to strike the ideal balance between the increase in modernisation-related rental prices and the savings in ancillary living costs for the tenants.

This strategy enables investors to significantly increase their rental income streams and – when it comes to making an exit – raise the achievable sale price of their real estate assets, while tenants hardly feel any financial impact from the investor’s value and yield gains. Moreover, the advantages of this socially responsible approach are not limited to the investor’s political and social reputation. At the same time, the approach is less susceptible to the two phenomena mentioned at the beginning of this article, which have recently caused steadily mounting problems for residential property investors: the broader political interventions in tenancy law on the one hand and the increasing housing burden on tenants on the other.

Explicit calls for energy-efficiency measures

Anyone who invests in energy-efficiency refurbishments and designs their modernisation measures to have as small an impact on tenants as possible has nothing to fear from politicians, who know that existing living space needs to be modernised in order to make progress towards national climate protection targets. Just like new construction, energy-efficiency measures are exempt from almost all tenancy law regulations introduced in recent years. In fact, energy-efficiency measures are not only permissible, they are expressly desired. With a strategy of consistent energy and ancillary cost optimisation, an investor’s exposure to future political interventions is therefore just as low as the risk of being unable to increase rental yields as a result of reaching the maximum limit of what tenants can afford to pay for their housing.

Investors who adopt socially responsible and ecologically sustainable approaches also have advantages in other business areas – be it housing privatisation or major new construction projects. While both are attracting more and more investors, it is important to recognise that being successful in either of these fields relies largely on cultivating positive relationships with local authorities. Consistent ancillary cost management, therefore, offers multiple benefits. Not only does it have a positive impact on ROI, it also helps to reduce investment risk, as well as improving the likelihood that an investor will be able to diversify their investments within the residential segment.

Andre Schmöller | Chief Investment Officer of Domicil Real Estate AG

For years, property prices have only been moving in one direction: upwards. In recent months, however, the coronavirus crisis has certainly put a damper on prices. As things currently stand, we are certain that the consequences will remain manageable for our segment, housing. “Business as usual” would perhaps be an overstatement, but overall, our day-to-day business at Domicil is running as usual. Even though purchases sometimes take longer to complete because there are fewer notary appointments available due to Covid-19 restrictions, demand for condominiums remains high. While the supply of properties in the EUR-10-million-plus segment has declined slightly, there is also a noticeable reduction in the number of competitors for these properties. While quite a few companies are currently standing on the sidelines having adopted a wait-and-see approach, others cannot or do not want to be active on the buyer side right now. A priority is already more important than anything else priority for us in these times is to protect our employees, customers and partners. However, thanks to our remote working systems and digitalisation measures, which include digital data rooms and a sales partner portal, we are able to maintain our business operations without restrictions.

We need to think long term

Given the constant and consistent cash flows the residential investment market and rental apartments in particular generate, demand has risen as investors seek a “safe haven”. According to a recent survey on the effects of the corona pandemic on investment decisions conducted by Fondsforum, institutional buyers believe that the short-term price corrections on the residential property market will create a growing number of attractive opportunities for acquisitions.

Investors with long-term investment strategies, for whom high purchase prices and low rental yields have recently become a nuisance or even a test of endurance, may well take a different view, at least for the time being. The analysts at Empirica have predicted price declines of 10% to 25% for the German market, whilst also noting that rents should remain stable. According to Empirica, we are likely to see the first indications of a price rebound as early as 2021. This provides a small window of opportunity for investors to increase the average rental yield from their portfolios.

Residential real estate investors therefore have less to worry about in this threatening economic environment than investors in the hotel segment, for example. After all, residential real estate investors will once again be able to enter increased purchase and rental yields on the credit side as soon as the housing market regains its former strength after the crisis – and it will. After a brief emergency stop in response to the coronavirus countermeasures, rents should return to the previous year’s level by 2021 at the latest.

“Bargain hunters” should not be blind to the risks

So good news from all sides? Well, yes and no. Simply assuming that a relatively low entry price and a good location make for an attractive investment can lead to investment mistakes. Even with theoretical discounts of 20% – and we are nowhere near those kinds of discounts yet – a lot can go wrong. Potential investors should always ask themselves: “Which locations and properties offer the best long-term potential?” This question is more important now than ever, especially with dark clouds gathering on the economic horizon. And there are two significant risks lurking behind these supposedly favourable conditions for market entry:

Who wants to miss out on the opportunity to acquire an attractive asset far below its true value? The real danger right now is that an investor’s determination to snap up a “bargain” will make them rush their due diligence and overlook potential shortcomings regarding the medium and long-term potential of a location and property. Alternatively, an investor might spend too much time assessing an opportunity and miss the best time to enter the market. In this latter case, the investor will go home -handed. But that is still better than ending up with a millstone – in the form of a suboptimal property – around your neck. Moreover, investors cannot afford to turn a blind eye to regional regulatory frameworks – maintenance statutes here, rent freezes and rent brakes there. And that is to say nothing of the different rent caps and the variations in rent indexes at municipal level.

Investors who are keen to take advantage of current opportunities to enter the residential market need regional market expertise now more than ever before, especially when it comes to assessing the “bargains” coming to market. And if they do not have their own in-house expertise, they would be well advised to rely on partners and service providers who do. Otherwise, the risks for investors are incalculable – especially at a time of crisis like this.

Market expertise should be a self-evident principle, but it is at risk of being forgotten in the rush to “buy the dip” that has already gripped the stock markets and some real estate investors. After all, snapping up a “bargain” today could leave an investor facing heavy losses tomorrow.

Jürgen Michael Schick | President of the German Real Estate Association IVD

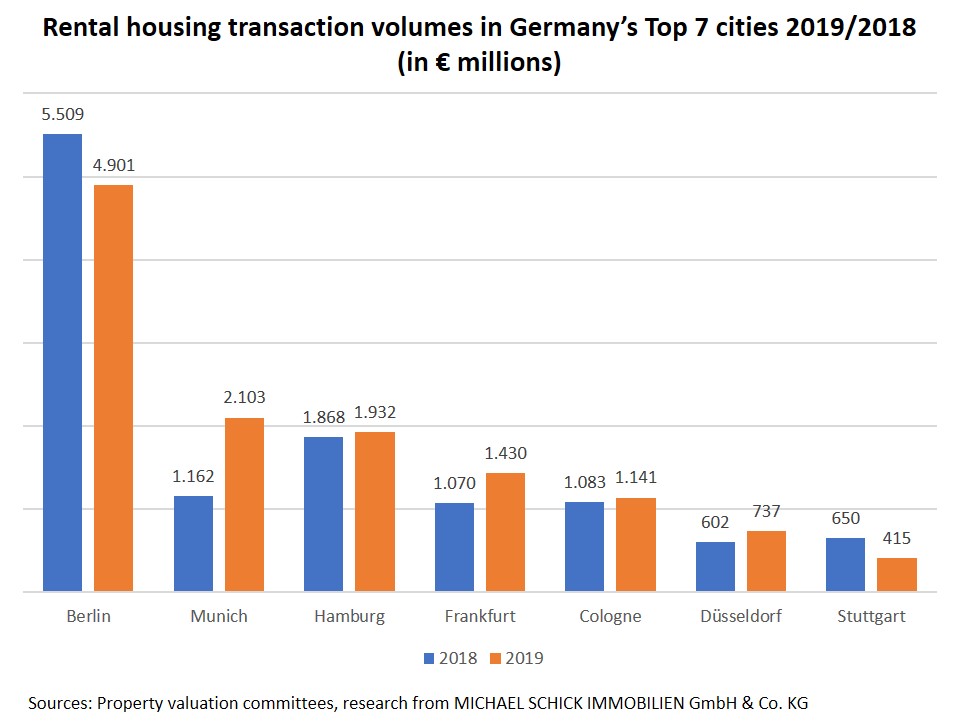

Right now, many investors are intensively examining the markets to decide where they want to acquire properties in the future. Residential investments are likely to be the winners of the corona crisis. But which markets are particularly attractive? In a comparison of the Top 7 cities, Berlin ranks far ahead of all other major German cities with a transaction volume of EUR 4.9 billion. In terms of transaction volume, the Munich rental housing market represents just 43 percent of Berlin’s total. In Hamburg it is 39 percent compared to the German capital. This is followed by Frankfurt at 29 percent and Cologne at 23 percent. Stuttgart brings up the rear at 8.5 percent of Berlin’s transaction volume.

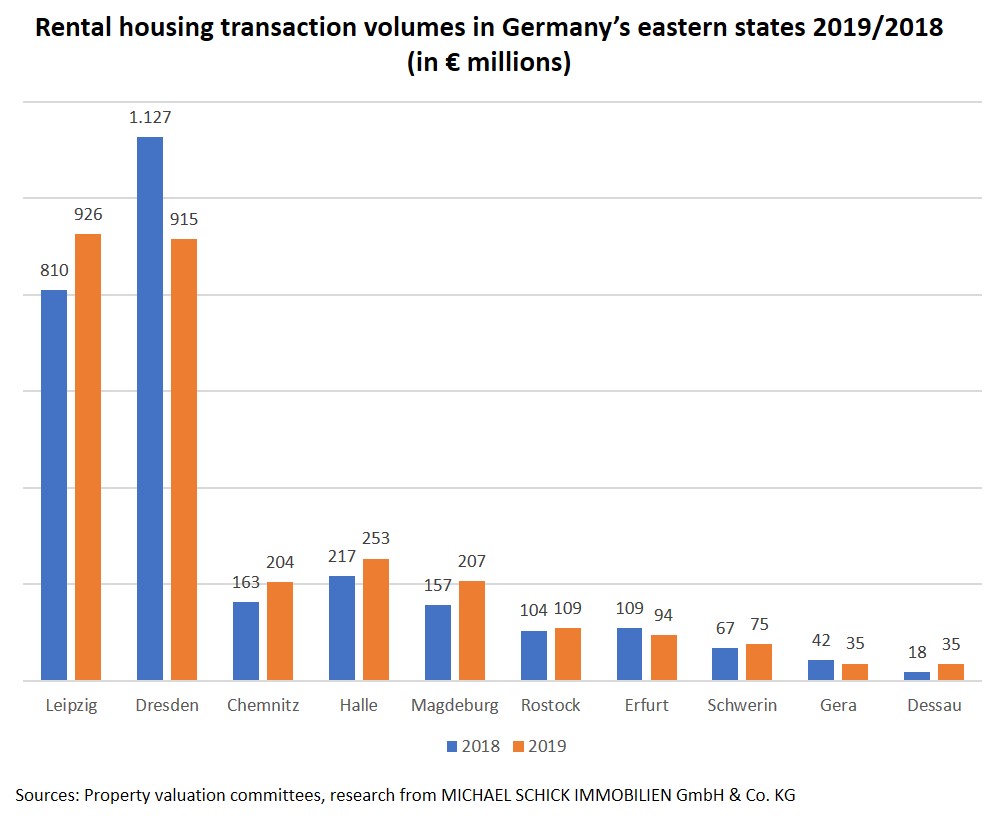

Central Germany is booming

Cities in Central Germany have experienced particularly strong investor interest in the past year. I assume that this will continue to be the case in the future and that demand there will continue to rise. As estate agents we have experienced this ourselves and can easily back up the official figures with our own track record. The two major hotspots are still Leipzig and Dresden. While in Dresden investments in apartment buildings fell by 18.8 percent in 2019 compared to 2018, in Leipzig it rose by 14.4 percent. Declining transaction volumes have been observed in many German cities. In many cases, there is simply a shortage of product coming to market. In Berlin, too, transactions involving apartment buildings were down by 11 percent in 2019 compared to 2018. Of course, the controversial discussion about the Berlin rent cap is a specific feature of this market.

In contrast, transaction volumes in seven leading real estate markets in eastern Germany have risen by double-digit percentages. In Magdeburg (+31.7 percent), Jena (+29.5 percent) and Chemnitz (+25.0 percent), the growth in transaction volumes was particularly impressive. The same applies to Halle (+16 percent) and Schwerin (+12 percent). In the small Dessau market, the transaction volume increased by a staggering 92 percent.

In the post-corona period, investors will be even more sensitive in their search for high-growth markets. In my view, central Germany will retain its status as an attractive market and as a complement to investments in the major metropolises. These markets remain particularly dynamic. In view of the 400 transactions in the Leipzig apartment building market and 325 in Dresden, the high number of acquisitions in the other cities is pleasantly surprising. In the ranking of transactions, Chemnitz comes third in central Germany with 260 apartment building deals, followed by Halle with 174 and Magdeburg with 169 transactions. Incidentally, in Berlin there were “only” 887 transactions (-13 percent) in the same period.

On average, an apartment building costs the most per square metre in Dresden (EUR 2,020 / sqm). In Leipzig buyers are paying an average of EUR 1,659 per square metre, in Halle EUR 1,281 per square metre, in Magdeburg EUR 1,223 per square metre and in Chemnitz EUR 987 per square metre.

According to the new Housing Cost Report from the Institut der deutschen Wirtschaft (IW), the German housing market has a good chance of emerging from the corona crisis and the subsequent economic slump unscathed. Admittedly, the report only presents data up to the end of 2019. Nevertheless, it is possible to make a forecast: As neither the rental costs nor the housing costs for owner-occupiers were previously overvalued, a collapse is unlikely. Buying residential property in Germany is still significantly cheaper than renting it. The cost advantage of living in a condominium compared to a similar rented apartment was 48.5 percent nationwide in 2019. According to the study, owner-occupiers have much lower housing costs than tenants in almost all German regions, including the major cities. In its fifth edition of the annual Housing Cost Report, IW compares housing costs for owner-occupiers and tenants. The report’s calculations are based on a comparison of the net rent paid by tenants with the costs of owner-occupiers, including the purchase price, ancillary acquisition costs, mortgage interest and lost interest on equity capital as well as repairs and depreciation.

In addition to the Federal Constitutional Court, the Berlin Constitutional Court will also review the city’s rent cap and rent freeze regulations. Burkard Dregger, chairman of the Berlin CDU faction, and Sebastian Czaja, leader of the Berlin FDP faction, filed an application for a judicial review of the rent cap at the Berlin Constitutional Court at the end of May. The complaint is more far-reaching than that of the FDP and CDU/CSU in the Bundestag, which was recently filed with the Federal Constitutional Court in Karlsruhe. The plaintiffs argue that the rent cap deprives tenants of legal security. According to Dregger, there is uncertainty, especially among landlords, as to the future of the rent freeze. In addition to legal concerns, Dregger complains that the rent cap law undermines landlords’ financial plans for their retirement. Moreover, there are still constitutional doubts as to whether the state is overreaching and interfering with the legislative competence of the federal government.

According to the German Federal Statistical Office (Destatis), 293,000 apartments were completed in Germany in 2019. The last time a higher number of dwellings were completed was in 2001 (326,600). As Destatis further reports, this was an increase of 2.0 percent or 5,700 completed dwellings compared to the previous year. There was also a significant increase in the number of building permits issued in 2019, which rose by 4.0 percent year-on-year to 360,600. This led to a surplus of 740,400 approved but not yet completed apartments.

The three properties comprise 40 apartments and five commercial units, twelve parking spaces and a garage. Thirty-three of the apartments and one of the commercial units are currently unoccupied. Floor plans vary from 30 to 102 square metres. One of the buildings has historical preservation status. The properties are in the immediate vicinity of Leipzig’s main railway station.

Price: EUR 4,700,000 plus 5.95% sales commission (incl. sales tax)

Lettable floor space: 3,245 sqm

Price per sqm: EUR 1,448

Information acc. to energy performance certificate: energy consumption 105.1 kWh/(m²*a), energy-efficiency class D, oil heating, built in 1906

(Please quote property reference number 51886 when making your enquiry)

These two extensively modernised mixed-use residential / commercial properties consist of a corner and a street-facing building and were built in 1904. The properties have four full floors, a converted attic and a full basement. In total, the two buildings comprise 37 apartments and three commercial units. Apartment floor plans range from 35 to 90 square metres.

Price: EUR 8,000,000 plus 7.14% sales commission (incl. sales tax)

Lettable floor space: 2,806 sqm

Net annual rent: EUR 278,680

Information acc. to energy performance certificate: energy consumption 110.5 kWh/(m²*a), energy-efficiency class D, gas central heating, built in 1904

(Please quote property reference number 52229 when making your enquiry)

At an ultra-prime location in Berlin, this sophisticated condominium leaves no wishes unfulfilled. Situated on the building’s first upper floor, the apartment offers the highest levels of comfort and convenience combined with state-of-the-art technologies. The exclusive appointments include the finest marble bathrooms, underfloor heating and a lift. A concierge is available around the clock.

Price: EUR 2,950,000 plus 5.96% sales commission (incl. sales tax)

Floor space: 257 sqm

Underground parking spaces: two

Information acc. to energy performance certificate: energy consumption 92.2 kWh/(m²*a), energy-efficiency class C, CHP, fossil fuel, electricity mix, built in 2003

(Please quote property reference number 52160 when making your enquiry)