EDITORIAL

Dear Reader,

In a world increasingly dominated by social media, opinions are becoming more polarised than ever before. Issues are often presented as either snow-white or pitch-black. But we live in a highly complex world in which it is not a matter of quick answers but clever compromises, as perfectly demonstrated by Berlin’s Alliance for Affordable Housing.

By now, it should be clear to even the most die-hard optimists among us that Germany is not going to achieve its target of building 400,000 new housing units per year anytime soon. Many will dismiss the wide-ranging raft of measures and initiatives adopted in October as little more than actionism. In all likelihood, only a small number of these plans will actually be implemented – but firstly, even that would be an important partial success and secondly, the promotion of home ownership has moved a big step closer. We should by no means underestimate these latest developments.

Nevertheless, the housing industry is now faced with the task of finding solutions at a time of delayed construction projects and challenging financing conditions. Because any political tailwind, no matter how great, is useless if we can’t deliver the right products.

We hope you enjoy reading this latest edition of our newsletter.

Jürgen Michael Schick & Holger Friedrichs

ARTICLES

The new forward deal for more living space

Michael Peter | Founder and CEO, P&P Group

The entire construction industry will have to adjust to many an unpleasant new reality. The traditional forward deal no longer works. In the current crisis, developers are unable to rely on business as usual because of highly fluctuating costs. The solution? We need a “new forward deal”.

Property developers are undeniably facing a host of challenges right now. The ongoing coronavirus pandemic may have more recently taken a bit of a back seat due to new problems, but it triggered a severe crisis that has only been exacerbated by Russia’s war in Ukraine. In addition, the construction industry is short of materials and skilled workers.

To survive such hard times, developers need firm financial or entrepreneurial foundations. In other words, they need to fall back on the decent cushion that they have – hopefully – built up in better times. But in recent years, many new companies have pounced on the supposedly richly laid buffet of the German real estate industry. Some obviously didn’t anticipate a crisis – which is why the current situation is now catching these companies cold.

The prevailing scepticism towards forward deals is therefore hardly surprising. After all, investors find themselves having to ask whether the companies they are working with will even exist by the time the deal closes. Small and medium-sized companies will be swallowed up by better positioned developers – a consolidation of the market is imminent. It is already almost impossible for struggling developers to get a loan.

No relief for the housing market

Against this background, there is little likelihood of a housing construction boom. Yet there is an enormous need: Germany already has a serious housing shortage – and 500,000 apartments will be needed to house refugees from Ukraine alone, according to empirica. But new housing requires more than just an uptick in building permits. Even once a permit has been issued, it still takes an average of two years before construction begins. There is also a lack of suitable building land, especially in major cities.

The markets are uncertain – and not just in Germany

To make matters worse, Germany has also recently become less attractive to some foreign investors and developers. The once “safe haven” now finds itself with storms to contend with. And the decisions of investors from abroad are always influenced by a country’s energy policies. How we master the enormous challenge posed by climate change therefore has an impact not only on all of our lives, but also on how competitive we are on the international stage. Companies certainly have obligations, but they are not the only ones. Our political leaders must also create the necessary framework conditions.

Hard times for the forward deal

Anyone who signed a contract a year ago at a fixed price and with a clear scope of services must stick to it – no matter how much the situation on the markets has changed in the meantime. Over the last few years, forward deals boomed as investors sought to secure the scarce commodity that is real estate. But in times of rising interest rates, growing inflation and falling purchase prices, calculations are now often not worth the paper they are written on. Yesterday’s favourite deal has thus become far too risky – for developers and investors alike.

So, will we in future only see buyer and seller start to negotiate the price of a property after completion? That is a possibility, but it would be premature to shelve the forward deal entirely. Nevertheless, it must be adapted to the current situation so that the risk remains manageable. For example, the contracting parties could examine whether they can include additional parameters to restore certainty for both sides. On this basis, deals that serve the interests of both parties could again be struck in the early stages of a project. And preparations for a worst-case scenario should always be included in any calculations.

The days when market participants could rely on a constantly growing market to help them balance their books are definitely over. The subsidised real estate boom is over. The cost of money is rising and the market cycle is back. For experienced property developers, this comes as no surprise. What’s more, for developers whose experience has prepared them for the end of the upswing, we are now entering a phase of attractive opportunities.

The sleeping giant of equity release

Sabine Nass | CEO, Deutsche Teilkauf

There is a particularly promising approach to selling real estate that has long been familiar and widely used in the United States and Great Britain, but is quite rare in Germany. Equity release offers homeowners a way to unlock the equity tied up in their residential property – in other words, to turn their home back into cash – and without having to move out of their house or apartment. There is enormous potential in this concept, which has hardly even begun to be tapped in Germany. In fact, just one per cent of the market potential in Germany, estimated at more than EUR 300 billion, is presently being leveraged.

This currently under-developed market is, however, set to evolve rapidly over the next few years. For one thing, German homeowners will increasingly need equity release offers, primarily as a result of irreversible demographic trends. By 2036, according to data from the German Federal Statistical Office, a majority of Germany’s post-WWII baby boom generation will have reached or passed retirement age. There will be as many as 12.9 million retirees, including a large proportion who became homeowners during their working lives. With so many Germans in and entering retirement, there is clearly significant potential for new customers for equity release providers.

Throughout their lives, these homeowners have invested a substantial portion of their incomes in their own four walls. After retirement, however, they often find that they have a significantly smaller income at their disposal. At the same time, almost all of their equity is tied up in their own home. Last year, Deutsche Teilkauf conducted a survey to assess the extent of this situation in Germany. Accordingly, there are around 3.3 million senior households whose spending power has been reduced. Of course, by no means all of them are struggling to make ends meet. Some may just want to fulfil a long-held dream, while others will be interested in creating a buffer to deal with rising utility bills. Some will be hoping to free up equity in order to make their homes more “senior-friendly” and some will be eager to support their children or grandchildren.

At the same time, equity release can be an equally interesting proposition for those to whom none of the above applies. Anyone who wants to invest in as diversified a range of assets as possible should not have all of their equity tied up in a single property. This is especially true for homeowners who have invested much of their income and their entire savings in their own four walls during their working lives. This has little to do with risk diversification. Some baby boomers are simply likely to want to take advantage of the strong property price increases in recent years to realise gains in the value of their own property and invest the capital in other assets.

As a product, equity release also benefits from there being fewer alternatives than in the past for homeowners who want to generate cash from their property but don’t want to sell it outright. These days, for example, it is almost impossible for older homeowners to remortgage their homes. Since the implementation of the Housing Credit Directive in March 2016, the criteria used by banks and other lenders for their mortgage lending decisions have become much more strictly regulated. This has affected older borrowers in particular.

Wherever there is demand, there is supply. It is therefore not at all surprising that the number – and diversity – of equity release models has increased, albeit still at a low level. Since there are also models with transparent, fixed, one-time pay-outs, it is no longer necessary to rely on annuity models and thus on a “bet on death”.

From an investor’s perspective, too, there are strong arguments in favour of equity release models. Above all, investors can gain access to a real estate class that is otherwise difficult to invest in: occupied existing single-family homes – a market that it has been hardly possible to tap due to its small-scale nature and high acquisition costs. Moreover, this limited commodity is becoming increasingly rare, as more and more large cities are relying (almost) exclusively on the construction of multifamily housing.

Moreover, owner-occupied and mortgage-free single-family homes are widely regarded as highly resilient to market fluctuations and, thanks to their granularity, offer a high measure of risk diversification and an attractive risk-return profile to any investment portfolio. Thus, on both the supply and demand side, the best conditions are in place for this sleeping giant to slowly awaken. To achieve this, however, there is still a need to raise awareness of equity release models on all sides.

Rising energy costs justify lower purchase prices

David Peter | Managing Partner, Connex Group

Nothing affects the real estate market as much as rising interest rates. But they are by no means the only price-driving factor. In fact, investors can expect prices to fall further in the coming months, because energy requirements are rising in line with energy prices. Wherever there are future requirements for expensive energy-saving measures, owners will be left with little choice but to sell at a substantial discount, irrespective of which current legal standards they fulfil.

This is because the current crises have driven ancillary housing costs to an all-time high. The so-called “second rent” is becoming more and more expensive and is already a decisive factor in the rental and purchase of residential real estate.

Traditionally, ancillary housing costs were equivalent to about one third of a tenant’s basic rent. As recently as November last year, a study from d.i.i. Deutsche Invest Immobilien AG and the Cologne Institute for Economic Research (IW) reported “non-energy-related operating costs” of €1.00/sqm of living space and costs of €1.09/sqm for heating in many municipalities. That was before the highly dynamic developments during the course of this year. From July 2021 to July 2022 alone, the Federal Statistical Office the Federal Statistical Office reported that prices for energy products rose by 35.5 per cent. The inflation rate for electricity in July, for example, was 18.1 per cent. This leaves tenants facing additional costs of up to several hundred euros per month.

Energy-efficient refurbishment as a key selling point

Given to the recent rises in energy prices, prospective tenants will increasingly look at a building’s energy efficiency before they decide whether to sign a lease or not. Factors such as the age of the windows, the building materials, roof insulation, heating system and insulation of the facade will become more and more important. Structural vacancy in inefficient buildings will increase sharply (even with a housing shortage), as no tenant will want to or be able to bear excessively high service charge payments. The only way to compensate for this would be to reduce the tenant’s net rent. However, this would also result in a reduction of the purchase price, as the basis for calculating property purchase prices in Germany is the price-to-rent ratio, which is based on annual rental income.

What’s more, many tenants will be willing to pay a premium to live in a property that has undergone an energetic refurbishment or in a unit in an energetically refurbished building because they will appreciate the potential for operating cost savings. Certainly, many tenants are quite indifferent to how the rent is calculated. All they are really concerned about is the bottom line: that the total rental burden is not higher.

While owners of inefficient buildings will have to reduce their net rents in order to maintain the status quo and attract new tenants, owners of energy-efficient buildings will be able to at least hold the rents they charge, if not increase them, because there is such a short supply of energy-efficient housing. Thus, inefficient buildings will become increasingly difficult to rent out.

Expect purchase price discounts

For the same reasons set out above, we will see a decline in purchase prices for properties in need of renovation. The full extent of this decline will depend very much on the location and the respective condition of the individual property. Buyers and sellers will need to make sure they do their due diligence and make well-informed decisions. Some properties may have upgraded windows but old roofs or heating systems – or vice versa. Buyers are well advised to let their buying decisions be guided by the price-to-rent ratio – in other words, to set themselves a target of how many years it should take for the property to pay for itself.

As the latest real estate offers demonstrate, we are already seeing interest-rate-related discounts of around 25 per cent. Now we need to prepare for the energy-inefficiency-related discounts. As a rule of thumb, these will amount to up to 20 per cent for buildings with an average or poor energy balance, depending on the property’s location and overall condition.

Price reductions for less efficient heating systems

The biggest energy-efficiency (and therefore operating cost) factors are a building’s heating system, its roof and its facade. The greatest leverage for purchase price adjustments can be found in the heating system. The decisive factor here is the system’s energy source. Right now, the electric storage heater is experiencing a renaissance as governments decouple gas and electricity prices, which should make heating with electricity much more affordable.

Investors who buy properties with gas-fired central heating will need to include a new heating system in their budgets. Firstly, because otherwise their tenants will no longer be able to afford the operating costs, and secondly, because the switch to renewable energy sources has to take place by 2035 anyway. Prospective buyers should therefore first take a look at a property’s boiler room before even thinking about negotiating a price.

The simple fact of the matter is that rapidly rising utility bills will put ever-increasing pressure on basic rents. And if something doesn’t give, tenants will be overburdened by the total costs. If owners and buyers hope to keep a lid on rents, or even increase them, they cannot avoid measures to boost their buildings’ energy efficiency.

Who are the winners of the current crisis?

Jürgen Michael Schick, FRICS | Präsident des IVD, Immobilien Verband Deutschland e.V.

Interest rate hikes, hesitant buyers, anxious investors, energy crisis – the real estate industry has shifted from a seller’s to a buyer’s market at breakneck speed. As the dust begins to settle, the real estate industry’s winners and losers are emerging. The waves of cancellations at brokerage houses such as McMakler, Homeday and Ziegert, the insolvencies of platforms such as Realbest, agents such as Comfort, and developers such as Terragon, are harbingers of the further upheaval to come.

But as the crisis continues, who are the winners?

Demand for housing has rarely been higher than it is today. This year alone, one million people have arrived in Germany from Ukraine. Migration within Germany and within Europe is creating additional demand in what have long been extremely tight housing markets. For the first time ever, the population of Germany exceeds 84 million. At the same time, housing construction is in decline and the gap between supply and demand continues to widen as the number of new buildings falls. And we all know where that will lead: rising rents.

Property owners are unlikely to have any problems finding new tenants. Anyone who has succeeded in building up an attractive property portfolio in recent years without having to angage in any significant new construction is significantly less impacted by the current confluence of crises than developers who are grappling with spiralling costs, rising interest rates and declining demand from prospective buyers.

For the first time in years, rents will rise at a faster rate than purchase prices. For years it was the other way around, at least on the residential property market. Purchase prices had become completely decoupled from moderate rental price developments. Now prices are falling and rents are rising.

Today, prospective buyers are once again finding properties coming to market at the kind of conditions they have been looking for in vain for years. The “over-30” party is over. And I’m not referring to the age of the most sought-after properties, but the much-hyped rent-to-price multiplier. While some investors still prefer to do keep their powder dry and bide their time, others have been busy taking advantage of the new market environment to make favourable acquisitions. Without bothersome competition from too many other buyers. For investors, the market is now full of opportunities.

Brokerage houses are experiencing an increase in properties for sale. For many years, estate agents’ prime concern was the shortage of properties coming to market. In the housing market, real estate portals even often offered leads for private owners. Agents who struggled to acquire new properties paid dearly for their failings. Looking ahead, the shortage of properties should be a thing of the past. It is now more a question of acquiring properties at prices in line with the market. Real estate companies with strong advisory skills are more in demand than ever before.

With wave after wave of layoffs at many real estate companies, the market now offers opportunities to companies that have got their costs under control and are pursuing a clear growth strategy. At SCHICK IMMOBILIEN, we are excited by this opportunity to identify valuable talent and offer them crisis-proof jobs as long-term residential investment brokers. The shortage of skilled workers is now easing. In the long run, the current market shake-out will be good for the industry.

There are losers in every crisis. But there are also winners.

News

Berlin Alliance for Affordable Housing takes stock

Initiated by the Berlin Senate and comprising municipal authorities, housing cooperatives, real estate companies and industry associations, an agreement to launch the Alliance for Affordable Housing was sealed in June, as reported here at the time. On October 11, 2022, after more than five months of working together, members of the alliance came together for a meeting at the Berlin Chancellery. In order to meet the demanding challenges created by the current macroeconomic environment and the tense housing market, the alliance launched the “Alliance for Affordable Housing – Measures for a Construction, Investment, and Innovation Offensive”, which sets out 130 specific measures to accelerate approval procedures and give construction a much-needed boost. IVD President Michael Schick believes that the package is “not a great success”, as too many compromises had to be made to satisfy the interests of all parties. However, Schick also remarked, the alliance has laid the political groundwork for implementing the measures without major delays.

No respite in sight for the Berlin housing market

After years of rising residential property prices in Berlin, the trend remains unbroken despite inflation, increasing energy and construction costs, and rising interest rates. As can be seen from the IVD Berlin-Brandenburg’s real estate price report for 2022/2023, from October 2021 to October 2022, prices for condominiums increased by an average of 7.3 per cent in upscale neighbourhoods and 5.9 per cent in normal neighbourhoods. According to the report, a 90-square-metre apartment now costs an average of EUR 4,400 per square metre in upscale residential locations and EUR 3,600 in simpler locations. On year ago, the prices were EUR 4,100 and EUR 3,400, which means that prices in more sought-after locations rose by EUR 300/sqm and in less fashionable locations by EUR 200/sqm. The top addresses in Berlin-Mitte continue to be the most expensive at EUR 5,900 per square metre, followed in second place by Charlottenburg at EUR 5,500. The most affordable prices are found in Marzahn-Hellersdorf and Spandau at EUR 3,100 and in Neukölln at EUR 3,200 per square metre.

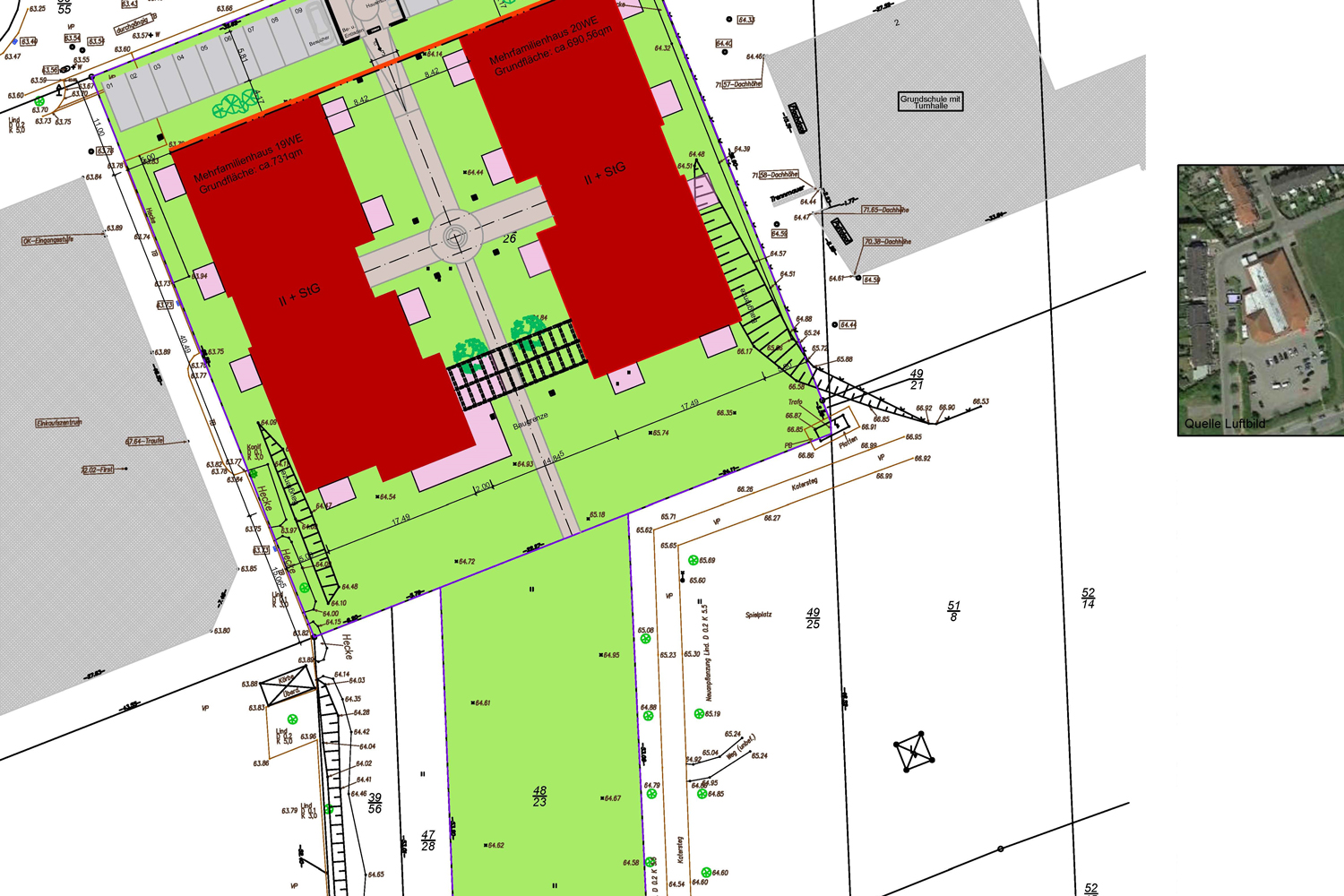

Social housing quotas in new construction push housing costs up

While conducting a study commissioned by Pandion to investigate the respective land development models and their impact on construction activity in the cities of Berlin, Düsseldorf, Hamburg and Munich, it became clear to bulwiengesa that the social housing quotas imposed by the cities have a significant impact on rents and purchase prices on the open housing market. For example, the surveyed cities require that least 30 to 50 per cent of newly constructed housing should be affordable units. However, the report explains, these quotas are impossible to fully satisfy: Despite subsidies to promote the construction of affordable housing, building costs are simply too high for developers. In privately financed housing, the required quotas would add up to 17 per cent to rents and up to 12 per cent to purchase prices. This is because subsidies only apply to the actual construction of the affordable units. The longer-term costs of the subsidised units have to be apportioned to the owners and residents in the open-market units. As a result, the report’s authors conclude, housing construction in Germany’s major cities will decline.